Can’t-Miss Takeaways Of Info About How To Buy Leap Options

When deciding which leaps to buy, it is important to consider the underlying asset and its expected performance.

How to buy leap options. Look for the options chain,. A leap option is essentially an option with longer terms than standard options. It's up to each brokerage to decide when to let you buy calls, but the.

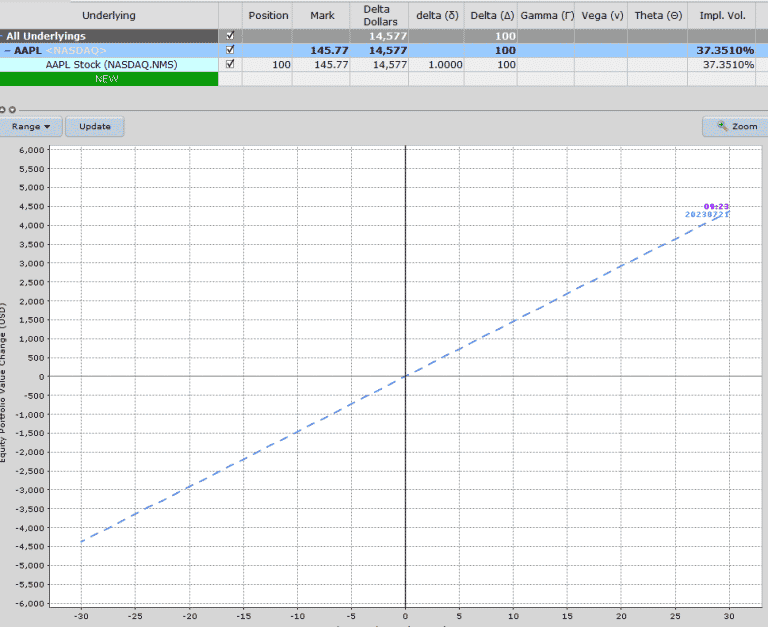

Here’s a method of using calls that might work for the beginning option trader: With leaps options, you can mimic the movement in stock prices and hold those positions as long as you would hold the shares. For bullish leaps options trading strategies, such as buying leaps calls or selling cash secured leaps puts, the key is to buy and sell options only on quality stocks.

The acronym leap stands for long term equity anticipation security and. Search for your desired leaps option. You can supersize your rent premiums with leap options.

Leap options (or leaps) are option contracts that expire at least one year from the date of purchase. Buying leaps calls if effectively like trading with leverage, allowing you to control a large. On your broker's trading platform, search for the ticker of the stock or etf you're interested in.

If you are bullish on a particular stock or. Today, we’re looking at how to buy leap options as a stock substitute. Leaps call options is a type of long term equity anticipation securities, which is a call options contract with at least 1 year to.

What are leaps call options? Now, we’re not talking about a 10. To buy leaps, you'll need a brokerage account with permission to buy call options contracts.

The difference is that they consist more of buying strategies because of the slower decay.

/cdn.vox-cdn.com/assets/1947803/leaphand.png)