Spectacular Info About How To Become Tax Accountant

Tax accountants, as the name suggests, specialise in one of the most intricate areas of finance:

How to become tax accountant. Process of becoming a tax accountant education requirements. In terms of job outlook, the data from the u.s. This course involves learning the ins and outs of preparing taxes and tax laws.

They ensure compliance with tax regulations and assist in tax planning to minimise tax liability. Key skills needed to become a chartered accountant include: Learn what a cpa is, what they do, and how to become one.

Generally, you have to complete studies in accounting at a college or university, which may include a tax prep class or other courses to learn about preparing taxes, auditing or even financial planning. An important difference in the types of practitioners is “representation rights.”. If possible, focus your course load on subjects related to writing, math and/or business, which are likely to prove useful in your career.

Find out the requirements, steps, and benefits of becoming a cpa in different states and career paths. Coursework often includes subjects such as business law, management, economics, finance, and, of course, taxes. Tax preparer salary.

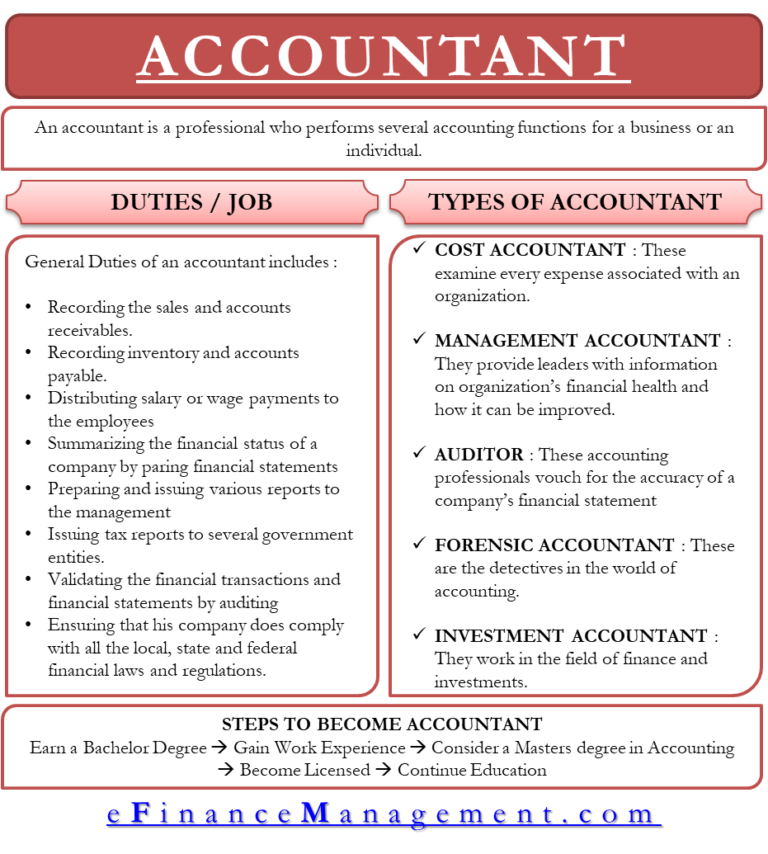

Bureau of labor statistics indicates that overall. Any tax professional with an irs preparer tax identification number (ptin) is authorized to prepare federal tax returns. Becoming an accountant involves a dedicated commitment to education and professional.

This program helps you develop a solid knowledge of the accounting industry, fostering skills like auditing, business ethics, and employment law. How to become a tax accountant: The good news is that to gain access to a career in accounting you don't need a levels or a degree.

You might also want to complete a college degree. To become a tax accountant, you typically need at least an undergraduate degree in one of the following fields: You may do so through a company or by purchasing the software yourself.

The average salary for an accounting assistant in the united states is $33,479 according to data from indeed. Here are a few steps you can take to learn how to become an accountant: Minimum fee, plus complexity fee:

The following article discusses the career path of tax accountant. Complete your education a high school diploma or ged is the minimum education requirement at many tax preparation companies. How to become a tax accountant if you want to work as a tax accountant, you'll need to gain a good education, have work experience and register with the tax practitioners board (tpb).

For accountants, it is $63,229 [ 1 ]. Here is guidance on each credential and qualification: Next, you will need access to tax preparation software.